Blog

How to Build Investor-Ready SaaS: From Architecture to Retention to Compliance

Alex Dimov

•

Dec 18, 2025, 10:00 AM

Investors evaluating SaaS products nowadays care about far more than a polished demo or a clean landing page. The bar has moved. With AI-native competitors entering every market and compliance expectations increasing across industries, investors expect early-stage products to demonstrate not only traction but technical maturity.

At Wecraft Media, we work with founders who want to build serious SaaS products. Many arrive with a clear vision but no framework for what “investor-ready” actually means. This article breaks that down into practical steps: architecture, scalability, retention, compliance, and the roadmap that connects them.

If you are preparing for pre-seed, seed, or Series A, this is your guide.

1. What Investors Expect in 2026 (and Why the Bar Has Risen)

Investor conversations in the past focused heavily on market size and product idea. Today, there is a new lens:

Does the product have data architecture that can support AI features later?

Will the platform scale without a rewrite?

Are security and compliance risks under control?

Is retention improving?

Does the team have a predictable delivery model?

The shift is happening because SaaS categories are crowded. Two products with similar features can look identical from the outside. Strong architecture, clean onboarding, and predictable performance signal that the startup can scale without burning capital.

This does not mean building an enterprise-grade system from day one. It means building the right foundations.

2. The Core of Being Investor-Ready: Your Architecture

2.1 Architecture Should Follow the Product Strategy

A mistake we often see from founders: the system grows feature by feature until it becomes impossible to maintain. Investors notice this. Technical due diligence today includes:

API and modularity review

Data model scalability

DevOps maturity

AI-readiness

Logging and observability

A founder does not need to speak the language of engineers. But a founder does need to know whether the system can survive growth.

2.2 The Three Architectural Layers Investors Care About

1. Application Layer

This includes the code structure, modularization, and maintainability. Red flags include:

“God classes” or massive services that do everything

No separation between business logic and infrastructure

Hard-coded configurations

A healthy application layer means new features can be built quickly and safely.

2. Data Layer

This is increasingly where the competitive advantage lies.

For an investor, the key questions are:

Can the system support analytics and AI later?

Is data stored in a way that allows insights and automation?

Is the schema stable and documented?

3 AI-Ready Does Not Mean AI-Built

Some founders try to integrate AI too early.

Being AI-ready simply means:

clean, structured data

events that can be tracked and labeled

a storage solution able to support vector search or streaming later

permission and compliance rules clear from the beginning

When we build MVPs with clients, we design these foundations even when AI is not part of v1.

3. Retention: The Metric Investors Now Prioritize

3.1 Why Retention Has Become the New Growth

In SaaS, high churn destroys valuation. Investors prefer a product with slower acquisition but strong retention over a fast-growing product that loses users monthly.

The key metric:

NRR – Net Revenue Retention

NRR above 100 percent signals that users are not only staying but expanding their usage. Top SaaS companies operate around 120 percent or higher.

3.2 What Drives Retention in Early-Stage SaaS

1. Onboarding that produces a “first win”

Onboarding must guide users to value quickly. Most MVPs fail here. Over-engineering features while neglecting onboarding is a common founder trap.

2. Clear product workflows

Users should immediately understand:

➡️ what the product does

➡️ what steps they should take

➡️ how they benefit

3. Usage visibility

Dashboards, progress indicators, and notifications reinforce engagement. They help users see actual value.

4. Continuous product improvement with predictable releases

Investors love teams that can deliver reliably. Predictable releases indicate strong engineering discipline.

At Wecraft, many founders hire us to not only build features but build the system that releases features without breaking everything else.

4. Compliance: The Hidden Deal-Breaker Founders Underestimate

Compliance has become a top concern for investors, especially in:

🏥 health

💵 finance

🔋 energy

✈️ mobility

✨ AI-driven products

Regulations like GDPR, HIPAA, SOC 2, and emerging AI legislation shape how products must operate. Ignoring compliance early creates technical debt that can cost tens of thousands to fix later.

4.1 The Compliance Checklist for Early-Stage SaaS

1. Data ownership and user consent

Every system should answer:

What data do we store?

Why do we store it?

How do users give consent?

How do they revoke it?

2. Data minimization

Store only what is needed. This reduces risk.

3. Access and roles

RBAC (role-based access control) is a must for any B2B SaaS.

4. Audit logs

Who accessed what and when. Investors absolutely check this.

5. Backups and disaster recovery

A startup cannot afford extended downtime.

4.2 AI Compliance Is Coming Fast

If your product uses AI, investors will ask:

Are prompts or user inputs stored?

Are personal data or sensitive fields used?

Can users request deletion of training data?

Building these systems early is far cheaper than retrofitting them later.

5. How to Build an Investor-Ready Roadmap

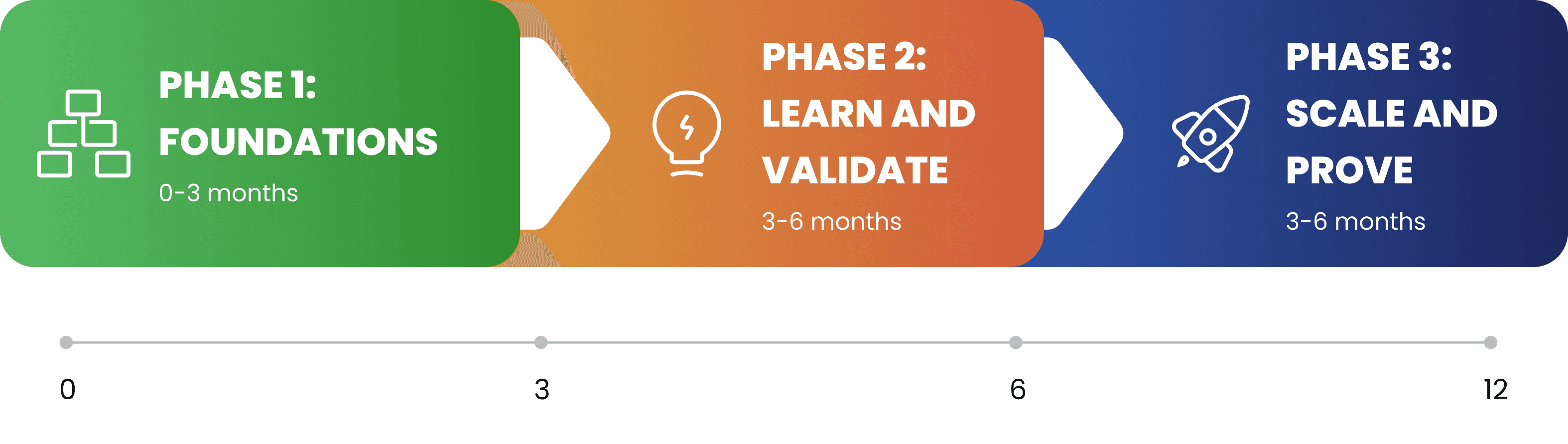

Below is a simple roadmap we use with founders during discovery workshops.

Phase 1: Foundations (0–3 months)

Scope the product around a clear value proposition

Map critical workflows

Create scalable architecture

Design the data model

Build an onboarding flow

Basic analytics and event tracking

First version of RBAC and audit logging

Phase 2: Learn and Validate (3–6 months)

Release core features in batches

Measure retention patterns

Improve onboarding based on data

Add usage dashboards

Strengthen security, logging, and documentation

Prepare for investor technical questions

Phase 3: Scale and Prove (6–12 months)

Introduce integrations that increase stickiness

Optimize performance

Add automation or basic AI workflows

Run reliability tests

Conduct light technical due diligence with an external team

Produce investor-ready architecture documentation

This roadmap shows investors that the founder is not just building a product but building a business.

6. Why Many Founders Struggle With This (and How to Fix It)

Most founders are not technical — and that is not a disadvantage. The real issue is working with development teams that:

overcomplicate early architecture

or build quick fixes that collapse later

or ignore compliance entirely

or deliver slowly without predictable release cycles

A strong development partner should:

translate business strategy into technical strategy

build systems for scale, not for chaos

ensure compliance from day one

help founders understand trade-offs

deliver predictably on a roadmap

This is the core of our work at Wecraft Media.

Conclusion: Investor-Ready Is a Process, Not a Milestone

Being investor-ready means having:

the architecture to grow

the retention metrics that prove value

the compliance foundation that avoids risk

the roadmap that ties everything together

Startups that adopt this mindset raise faster and scale smoother.

If you want to build an investor-ready SaaS platform, we can support you with architecture, product strategy, and long-term development.